RECOMMENDATION OF TAX EVASION

Believes that sanctions for money laundering tax evasion and tax fraud should be more severe and deterrent and that Member States should employ the risk-based approach when directing resources towards combating these illegal practices. From the famous to the infamous tax evaders end up paying a high price for their crimes.

What Is Tax Evasion The Motley Fool

Assessment of taxes owed and a demand for payment in order for tax evasion charges to be brought.

. Provided That in the case of a person engaged. Tax evasion is a predicate offence for money laundering under these standards. Tax Evasion Hall of Fame.

Believes that sanctions for money laundering tax evasion and tax fraud should be more severe and deterrent and that Member States should employ the risk-based approach when directing resources towards combating these illegal practices. Welcomes in this connection the Commission proposal for a directive of the European Parliament and of the Council on. If convicted tax evasion can result in fines of up to 250000 for individuals 500000 for corporations or imprisonment of up to five years or both plus court the cost of prosecution.

He was convicted of the largest tax evasion scam in US. Your Rapporteur also proposes that Member States revoke banking license to financial institutions if they actively assist in tax fraud by offering products. More recently the literature has examined more general models of the technology of avoidance with the additional risk bearing caused by tax evasion either being a special case of this technology or one aspect of the cost of changing behavior to reduce tax.

Tax laws tend to be complex and lengthy. We develop a consumption-based framework to assess the deadweight loss from income tax in the presence of tax evasion and show that the efficiency. The Recommendation recommends that Adherents strengthen their powers of.

He has contacted the IRS to establish a payment plan and is waiting on the agencys final determination. History for evading more than 200 million in. It is operating within the letter but perhaps not the spirit of the law.

That means that implementing the FATF standards supports efforts to stop tax evasion. On tax evasion modeled as a gamble against the enforcement capability of the state. However it e merges that the high tax rate level.

Recommendations set out the legal and regulatory measures that countries should take to. - Any person who carries on any business for which a private tax is imposed without paying the tax as required by law shall upon conviction for each act or omission be fined not less than Five thousand pesos but not more than Twenty thousand pesos and suffer imprisonment of not less than six months but not more than two years. The Recommendation on Tax Avoidance and Evasion was adopted by the OECD Council on 21 September 1977 on the proposal of the Committee on Fiscal Affairs.

Tax evasion is part of an overall definition of tax fraud which is illegal intentional non-payment of taxes. This handbook is not intended to create or confer any rights privileges or. When it comes to measures tackling tax fraud or tax evasion an illegal activity where tax liabilities are evaded Member States should allocate adequate resources to their national tax administrations and tax audit staff.

Tax evasion is the leading cause of the tax gap ie the difference between total tax liability and total tax paid. Evasion is usually done by not reporting income or overstating expenses. Recommendation following the inquir y on money launder ing tax avoidance and t ax evasion.

The proposals would see tax evasion becoming an offence that could lead to money laundering charges meaning that authorities would have a. Tax deficiency can arise by operation of law when there is a failure to file and the. An American entrepreneur Walter Anderson made his millions after the breakup of ATT.

Its estimated to stand at. Avoiding tax and bending the rules of the tax system is not illegal unlike tax evasion. Stipulated tax loss in full and has provided to the IRS all of the required tax forms and reviewed them in person with a revenue officer.

The FATF does not set the global standards for tax crimes or other. In most countries tax evasion would attract a jail term. This is a willful and deliberate violation by a tax payer to escape a legal tax obligation by failing to report a source of income or seeks to reduce his tax liability by understating a source of income to the Tax Authority.

Hence people with knowledge of these laws can end up paying significantly less tax than others. Tax matters and in evaluating recommendations for prosecution. However tax avoidance is not a criminal activity.

New FATF recommendations on tax evasion Locke Lord LLP. Welcomes in this connection the Commission proposal for a directive of the European Parliament and of the Council on. Influences tax evasion 31 said it affect to an agreed with the high tax rates influences tax evasion and only 10 said it does not affect.

European Parliament recommendation of 13 December 2017 to the Council and the Commission following the inquiry into money laundering tax avoidance and tax evasion 20163044RSP RECOMMENDATIONS.

The Levels Of Tax Evasion By Country Download Scientific Diagram

Pdf A Practical Guide To Setting Up Your Tax Evasion Game

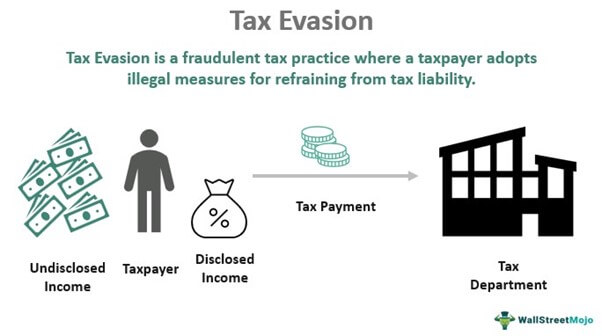

Tax Evasion Meaning Types Examples Penalties

Pdf Tax Evasion Tax Avoidance And The Influence Of Special Interest Groups Taxation In Iceland From 1930 To The Present

Tax Avoidance Tax Evasion Ppt Download

Pdf The Ethics Of Tax Evasion An Empirical Study Of New Zealand Opinion

Pdf Cheating Ourselves The Economics Of Tax Evasion

Pdf Taxpayers Subjective Concepts Of Taxes Tax Evasion And Tax Avoidance

Belum ada Komentar untuk "RECOMMENDATION OF TAX EVASION"

Posting Komentar